Simple BK

Bookkeeping for the iPhone®

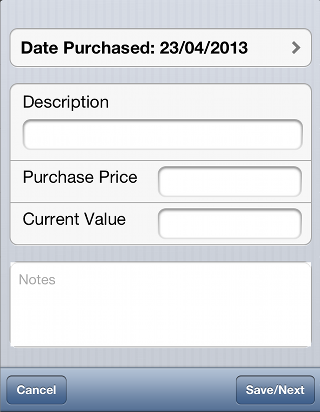

You can use this feature to track the original purchase price and current value of any capital purchases that you make where your tax authority treats capital puchases seperately to other expenses. This screen is used to input new capital items, use the Capital Purchases report to see a list of capital purchases and to edit individual records.

Tap 'Save/Next' when you have completed all the details you wish to record. You will not be able to save a record if any mandatory fields are missing. When all is well a 'Record Saved' message will appear and the phone will vibrate briefly to incicate that the record has been saved. Tapping on the Cancel button will clear the fields on the form when adding a new capital record, or return you to the capital list if you are editing an existing record.